It is expected that over the coming years the stock market will be more volatile than what we have experienced recently. Now is a good time to add companies which are better situated to survive in a volatile stock market. Below are two companies which meet these...

Stock Spotlight

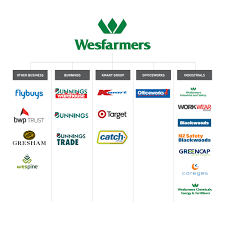

Email Alert – Wesfarmers

Wesfarmers share price has hit an all-time high, it performed exceptionally well during COVID with Bunnings having solid sale growth over this time and improved trading conditions with office works. The share price has rallied recently and is currently trading above...

Email Alert – Gold

Gold has certainly been on the nose over the last three months given expectations of an increase in inflation on the back of low interest rates, pushing housing prices higher as well as the vast amount of fiscal stimulus about to start around the world. We are looking...

1300 SMILES Limited

COVID-19 has led to an unpredictable outcome for the 2020year. 1300SMILES has performed well over the half-year and looked to capitaliseon the situation. Managing director, Daryl Holmes insisted on a vigorousand positive response to COVID-19. 1300SMILES half...

PARTNERS GROUP GLOBAL INCOME STRATEGY

Partners Group Global Income Fund (ASX: PGG) is a Listed Investment Trust that will provide investors with diversified exposure to private debt. It will be managed by Partners Group AG, one of the largest private markets investment managers in the world....

TABCORP Holdings Limited (ASX: TAH)

ABCORP Holdings Limited (ASX: TAH) is one of the world’s largest publicly listed gambling companies. It is the leading player in the Australian market with a suite of customer brands that include TAB, Keno, Luxbet, TabcorpSky Racing and Sky Sports. We like this...