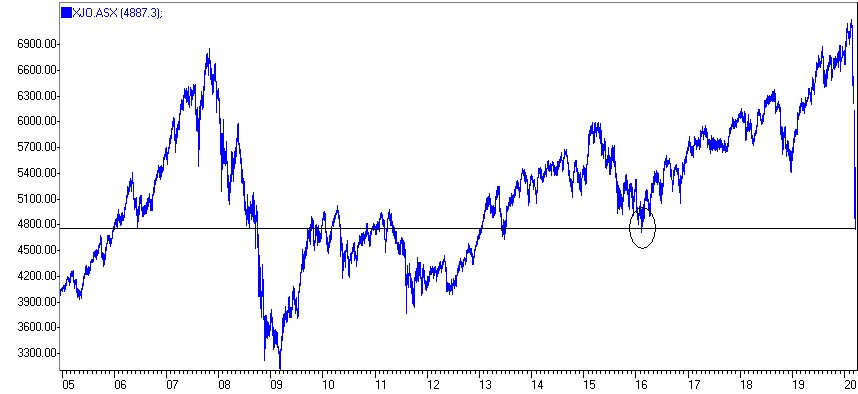

The ASX 200 continued its downward move this week closing at 4900 points with the market down 28% from the highs of only a month ago. The market has traced back to the lows of 2016 which is considered a resistance point. If the market bottoms around this level, we expect a quick recovery.

The catch is the COVID 19 factor. As governments continue to bring in more restrictions, further job losses will follow. It is this uncertainty which plagues the market. The market continues to struggle with the uncertainty of change, the more changes the more volatility we can expect.