Financial Services Townsville

Direct Equity Advice, Financial Planning, SuperannuationOur Strategy

To invest for long-term growth and income. We invest in solid businesses. The only way for us to make more money, is to grow YOUR Wealth.

Our Advisers

We have assembled a team of investment professionals with a high level of expertise across many facets of the wealth management equation. This diversity and depth of knowledge allows us to deliver personalised investment solutions that help clients achieve their financial goals. We believe our commitment to building long-term relationships with our clients differentiates us from other stock broking and financial groups. Our advisers have a combined experience of over 35 years in financial markets.

Jason Fittler

Jane Fittler

Authorised Representative: (398630)Jane is an Investment Adviser focusing on large net worth clients. Her goal is to help clients achieve a comfortable retirement.Jane holds a Bachelor of Laws Degree from James Cook University and a Graduate Certificate in Financial Planning.

HOW WE WORK

Conflict Free Advice

Not constrained

We are not constrained by having to offer products that are wholly owned by a parent company.

No conflicts.

Our advice is conflict free.

Your product first.

We choose for you the product that best suits your needs.

Same fees.

Our fee is the same no matter which product we choose for you.

Staff's remuneration.

No part of the our staff’s remuneration depends on how much of your money they invest within a certain product or service.

When You Are Ready To Grow Your Wealth,

Give Us A Call On 07 4771 4577.

CHECK OUT OUR LATEST WORK

Services & Fees

Praemium SMA

Better than a managed fund, you can see what is in your portfolio and you are the beneficial owner of the underlying shares.

Private Wealth Management

As a comprehensive and versatile investment platform, we provide the following administration services.

Self Managed Super Funds

A Self Managed Super Fund is your opportunity to take direct control of your financial future.

Fee Structure

Private Wealth Management | Brokerage | Fee for Service | Financial Planning

Latest Articles

Read this before investing in the stock market.

Companies also make profits and losses. When a company makes excess money, they have two choices:

1. Invest the money into growing the business by acquisitions or improve internal efficiencies to reduce costs.

2. Pay some of the surplus cash back to shareholders through dividends. Dividends may also come with franking credits as well.

Types of shares

Growth stocks are those companies that are considered to have the potential to outperform the overall market over time because of their future potential.

Value stocks are classified as companies that are currently trading below what they are really worth and will thus provide a superior return.

Diversification

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting exposure to any single asset or risk.

It is important to ensure that you do not under or over diversify your portfolio. The general rule of thumb is 20 shares in the portfolio however you would hold more for a large portfolio.

Risk Profile

Your risk profile sets out how much exposure you should have in each sector of the market such as Australian shares, International Shares, Property, Fixed interest and cash. How much weighting you have in each sector will increase or decrease depending on your risk profile.

There are five basic risk profiles:

1. Conservative

2. Moderately conservative

3. Balanced

4. Assertive

5. Aggressive

Before investing you should complete a risk profile to make sure you are investing at a risk level you are comfortable with. Getting this wrong will lead to bad financial decisions.

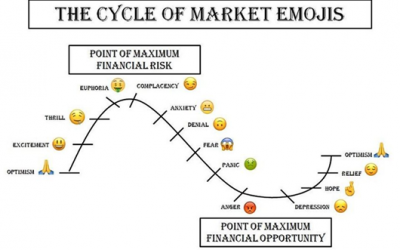

Most common mistakes made when investing in the stock market.

1. Getting stock tips from friends or family.

2. Not understanding the company, or investment you are buying.

3. Trying to time the market.

4. Panic when the market pulls back.

5. Lack of diversification

Research

Make sure you understand the company you are looking to buy. There is a lot of information on the internet but not all of it is there to help you. We recommend that you get professional advice. Professionals who work in the industry have access to research houses with daily updates on different shares and latest news on each company.

Accept that there is no free advice. Free advice is normally a sale pitch. There are a number of good research houses, but you will have to pay for them.

When starting, you will be best off having a stockbroker, it will cost more but a good stockbroker will save you more money than what they charge.

Market Fluctuations

The stock market is forward focused. It is looking at what is going to happen in the future and how this will affect the different companies which make up the stock market. Bad news may see the market in general fall, this does not mean that your shares are worthless it is the market building in a buffer. Same goes for good news when share prices are trading above their fair value.

Market fluctuations are an opportunity to either add to your holding at a discounted price or sell out part of your holding to take some profits. This call rebalancing, when to rebalance back to your risk profile.

Summary

Investing in direct equities provides you more control over your investments, which will generally lead to a better overall outcome for you the investor. But it is important to make sure you understand how it works before you start investing.

Investing is about, not losing money.

If you fail to plan, then you plan will fail. The first step in any endeavour is to understand what it is you want to achieve. You then need to plan out how you will achieve this goal. The big lie is that everyone can be a winner. This is not the case the world...

Looks like a recession is on the cards.

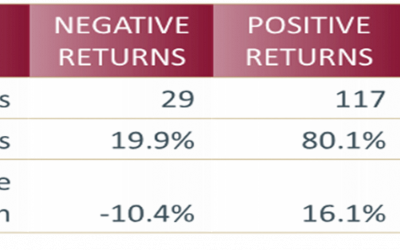

Reporting Season Positive – Future Headwinds

With the August reporting season, now closed overall the results were not as bad as expected. Most companies managed to cope with the rising cost and slow supply chains, with an underling demand for products and services, however, this maybe about to change. The...

2024 Wrap

The 2024 year has provided a 10% gain in the ASX 200, gold was up 28% and ten-year bonds were up. Is this the end of a two-year long bull market. If so, is it the start of a Goldilocks scenario? A Goldilocks environment is described as an ideal state for the economy,...

Time to adjust your portfolio.

The easiest way to make money is to not lose it. This August reporting season is shaping up to be a negative earnings year. At this point we are expecting the earnings per share will be down 3.5%, noting that the 2023 year was also down 2.9% as well. Two consecutive...

Holding Cash

Over the long-term holding cash will have a negative effect on your investments. We all know and understand the effects inflation has on cash. However, there are times when being overweight cash makes sense. Over the past twelve months the ASX 200 has returned...

Control your investment

Back in 2022 a financial advice company Dixon Advisory collapsed. I expect most of our clients would have been unaware of the collapse. I raise the issue now as we are once going into a more volatile time in the market. I have below included an article in regards...

Market Update

Over the last 12 months the NASDAQ 100 is up 28%, the S&P 500 is up 23% compared to the ASX 200 up 8%. So why has the market not pulled back? The economy has three main pillars: the consumer, corporates, and the government. First, most consumers in the...

The pay later budget!

The 2024 budget when viewed over the coming 12 months period is a positive budget, however, longer term it is setting up the economy for tough times. My review of the budget is focused on the impact it may have on the economy over the longer term. Let review the...

Two buys and one speculative stock

But first a quick market update. The market has gained around 10% since the start of 2024. The market concerns have focused on inflation however, now inflation seem to be under control. Interest rates are expected to hold at the current rate with expectations of...

Market Update

Interest Rates There is a lot of fuss around interest rates. Over the past six months all we have heard in the news is RBA, Inflation, Interest rates and Consumer Price Index (CPI). For most Australians, we understand that the economy is not doing well. For those who...

Iron Ore – time to review material companies.

Demand for iron ore is stagnating. China represents 71% of the global seaborne iron ore market. China’s housing sector has slowed down and the economy showing clear signs of maturity and saturation. With the slow down on building property in China we expect that...

Investing in 2024.

Investors always look forward for opportunities and look back to learn the lessons the market provides each year. 2023 was a tough year with most of the gains coming in the last quarter. 2023 closed with a 7.8% gain.In 2024 the expectations are that Material and...

December Update

Date 14/12/2023 Overvalued shares - Sell Fortescue Metals Group - fair value as $16.88/ share. At the last closing price of $17.59, FMG is trading at a 4.2% premium to our valuation. Accordingly, FMG is regarded as ‘Fairly valued’ at current levels. Given that the...

Time to be active.

Our economy is in a transitional phase. The government is facing tough decisions. The core issue is that inflation continues to stay at 5.2%, as opposed to the preferred 2.5%. Today the Government has raised interest rates by 25 bps to 4.35% to try and reduce...

Stock Highlight

It is expected that over the coming years the stock market will be more volatile than what we have experienced recently. Now is a good time to add companies which are better situated to survive in a volatile stock market. Below are two companies which meet these...

Market outlook for 2023 and beyond

The stock market is all about looking forward and knowing the past so you can be ahead of the curve. Bank Failures Two banks in America failed last week and there are expectations that other banks are also close. How does this happen? A simple explanation of how banks...

Before you start investing read this.

Investment Goals The goal of investing is to achieve passive income. Passive income is income which you do not need to work for. Before you start investing there are some basic concepts that you need to understand if not you will fail. Just reading this will put you...

Grow Your Wealth Market Update 11/01/2023

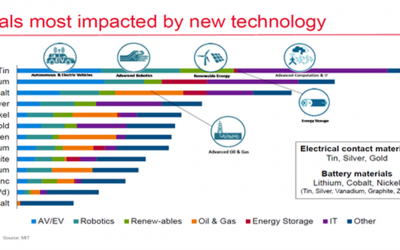

BATTERY METALS BOOM

The battery metals boom is primarily driven by commodity demand from present and predicted electric vehicle uptake. Article

How the 1% Invest

For those aspiring to grow their wealth, there is a simple lesson. The top 1%, invest 61% of their wealth in one asset. Click for article

Email Alert – Wesfarmers

Wesfarmers share price has hit an all-time high, it performed exceptionally well during COVID with Bunnings having solid sale growth over this time and improved trading conditions with office works. The share price has rallied recently and is currently trading above...

Budget 2021 Year

The Federal Government handed down its Budget for the 2021-22 financial year. Compared with last year’s record deficit of $213.7 billion,the underlying cash deficit is projected to decrease to $161 billion as the economy continues the path to recovery from Coronavirus...

Email Alert – Gold

Gold has certainly been on the nose over the last three months given expectations of an increase in inflation on the back of low interest rates, pushing housing prices higher as well as the vast amount of fiscal stimulus about to start around the world. We are looking...

1300 SMILES Limited

COVID-19 has led to an unpredictable outcome for the 2020year. 1300SMILES has performed well over the half-year and looked to capitaliseon the situation. Managing director, Daryl Holmes insisted on a vigorousand positive response to COVID-19. 1300SMILES half...

Grow Your Wealth – Market Wrap February 2021

The evidence is that valuation inthe US are stretched especially in the tech sector, there is a flood of IPOwith strong support and high valuations. At present the market is geared to 43%and bond rates are all time lows forcing fixed interest investors into riskier...

Grow Your Wealth – Market Wrap 18/09/2020

It has been a couple of months since our last Market Update, during that time nothing really changed. Our market continues and is still trading in arange between 6200 and 5800. Reporting season is over with results being slightly better than expectations and...

Grow Your Wealth – Market Wrap 17/07/2020

The big issue will be unemployment currently quoted at 7.5%. Job Keeper and Job Seeker are keeping the unemployment figures under control at present. However,these programs are to be wound back at end of September, the government is looking to provide a revise...

Grow Your Wealth – Market Wrap 03/07/2020

Our market has recovered 30% since the initial shock in March. But we are not alone, the US is leading the way and is currently now only down 7% from the pre COVID 19 levels. The ASX 200 is trading around 6000 points down around 17% from the pre COVID 19 highs. Click...

Grow Your Wealth – Market Wrap 19/06/2020

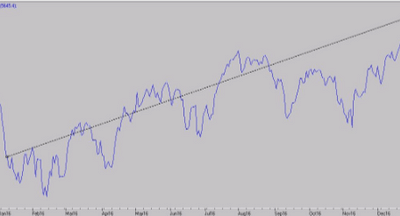

Back in Australia our recovery was 40% at its peak, but is now retracing back into a trading range. As shown in the below chart our market seem to be trading in a channel between 5750 and 6200. Volatility has is sitting around 24 which is still high but the trend is...

Grow Your Wealth – Market Wrap 05/06/2020

We could see our market move up another 5%, however we are still cautious on which companies we buy given that the bond market does not seem to be supporting the market at present. This could indicate a possible retest of the recent lows. Click for full article

Grow Your Wealth – Market Wrap – 22/05/2020

We do not recommend to heavily invest at these levels, now is the time to top up some holdings and to start building positions in new companies. It is also a good time to think about selling out those companies with a low chance of recovery. Click for full article

GROW YOUR WEALTH – MARKET WRAP 15/05/2020

Do not be fooled in to thinking, that everything is now OK, far from it. What we are seeing is the market hedging their bets on the recovery as restrictions are lifted. It will all be about the economic data over the coming months. This will be a slow long recovery,...

Grow Your Wealth Market Warp – 01/05/2020

For all of us dividend loving investors do not worry too much, it is more of a precaution which all of the banks will follow, Westpac has hinted that there will be no dividend this half. Bank stocks dropped over 5% on Friday on back of expectation all banks will...

Grow Your Wealth – Market Wrap 24/04/2020

The market this week found support around 5200 after falling at the start of the week. We are looking beyond COVID 19 and focusing on the economy and how the government will fund the stimulus package. What is clear is that interest rate will stay low for years while...

Grow Your Wealth – Market Wrap 17/04/2020

Another mixed week with the market closing up slightly. Most of the gains were made on Friday, given that the futures were barely positive as the start of the day I would contribute these gains to the news that we could see restrictions from COVID 19, start to be...

Market Wrap 09/04/2020

Going into the Easter break we expected that the market to close down as investor sit on the sideline over the Easter break.Instead it continued to hold around current levels. The banks came under fire as New Zealand put in place measure to ensure better liquidity in...

Market Wrap 02/04/2020

Last week the market closed at 4842, this week we closed up 225 points at 5067. There was more support for the market this week as it moved to it high in the middle of the week before pulling back on Friday. There is plenty of opportunity in the market to buy...

Market Update – 27/03/2020

The ASX 200 held its ground this week. In a falling market it provided some sweet relief, however, it did sell off in the last trading hours to end down 5.3% for the day leaving the market flat for the week. By no means do I expect that this is a bottom but it may...

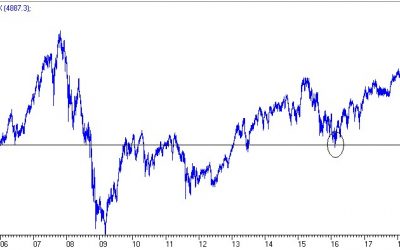

Market Update – 20/03/2020

The ASX 200 continued its downward move this week closing at 4900 points with the market down 28% from the highs of only a month ago. The market has traced back to the lows of 2016 which is considered a resistance point. If the market bottoms around this level, we...

COVID 19 – Grow Your Wealth Market Update

With the market recording some of the biggest drops in history what should you do as an investor. First, DO NOT PANIC, the time to panic has passed. What is the core reason for your investments? 1. Provide for living expenses. Make...

Grow Your Wealth – Newsletter February 2020

February was a big month for the market. With pressure building as the market continued to climb, we were expecting a pull back in the market. With company valuations already fully stretched we had been recommending to clients for the past quarter to look at taking...

Newsletter December 2019 – Investing in 2020

Looking forward what do we expect for 2020.With 2019 being a good year on the markets should we expect more? The US has also performed well over the 2019 year but much like Australia we are starting to see signs of the economy slowing down. Given the large gains in...

Monthly Newsletter September 2019

Right now we have a number of issues which affect not just our market but World markets. At this point the market looks to be heading to all new highs but we need to put this in perspective. Our market topped in 2007 at 6850 points, in July 2019 the...

Bitcoin – is it a investment?

Bitcoin is everywhere in the media at present, the value of a Bitcoin has passed $10,000, Bitcoin has been around since 2009. So why all ofthe hype now? This article will not explain how Bitcoin works there are plenty of You Tube clips for this, what I want to talk...

Grow Your Wealth – Monthly Update August 2019

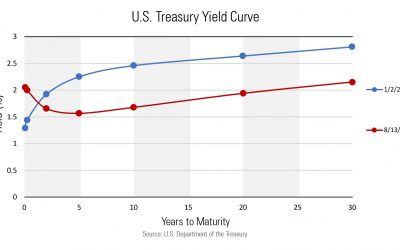

In a “normal” yield curve, long-term yields are higher than short-term yields. This makes sense because the longer someone borrows your money, the more you would expect them to pay you. A 5-year term deposit will pay a higher rate than a 6-month deposit because they...

PARTNERS GROUP GLOBAL INCOME STRATEGY

Partners Group Global Income Fund (ASX: PGG) is a Listed Investment Trust that will provide investors with diversified exposure to private debt. It will be managed by Partners Group AG, one of the largest private markets investment managers in the world....

Grow Your Wealth Newsletter – May 2019

With the surprise election result we have seen the market rally. We started May around 6360 points falling down to 6220 or 2.2% as we headed to the polls. With the LNP getting the win the market rallied back some 300 points or 4.8% over the following week, breaking...

Keep an eye on the Bond market today.

The ASX 200 will likely open moderately lower following mostly negative leads from overnight trading. Both Europe and Wall Street were lower, weighed down by weakness in tech shares.Bond yields and the Aussie dollar were higher, while commodities were mixed. On the...

Grow Your Wealth Monthly Newsletter April 2019

The Australian Market had a positive month in April, with a gain of 1.9%. Moving into May we are cautious due to the election and the uncertainty as to who will get in. Short term we expect that the market may pull back not just on the election but also as investors...

Proposed changes to your super under Labor

Proposed changes to your super under Labor Labor’s plan to axe cash refunds for excess franking credits and although this has hit the headlines they have other plans as well. Labor vows to · reduce the cap on...

Monthly Newsletter March 2019

The Australian Market went nowhere in March 2019. We saw a pullback in the early stage of the month as investors took some profits on the back of a concern over interest rates. Australia has at present an inverted yield curve which means that long term rates are lower...

Budget 2019

2019 Budget Below is a quick summary of the main announcements of this year’s budget, more detail will come out over time. For working Australia this Budget has a number of incentives and positive outcomes in real time. Other measure will take sometime to filter...

Monthly Newsletter February 2019

The Australian stock market had one of the strongest months on record with the ASX 200 producing a 4.9% gain for the month. Key highlight were companies reporting reduced profit growth which is indicating that we may start to see an economic slowdown. Banks stocks...

Franking and you.

Please note as there is no legislation out on this policy we are working on the information in press releases. Labors proposal to take away the refund of franking credits only indicates the lengths they will go to buy votes. Simply put this is taking money from what...

Market Wrap 06-03-2018

In 2013 the Australian market started the recovery out of the GFC. At this point volatility was still high it took two years before it broke through the 6000 points for the ASX 200 in February 2015. This was a mile stone as 6000 points was a resistance level. Over the...

End of Year Market Wrap 2017

Just over 12 months ago all we heard in the Media was Donald Trump, 12 months on not we are still hearing about Donald Trump but the wealth of the USA has increased. In fact the overseas has outperformed with Hong Kong up 29%, United States of America – NASDAQ up 29%,...

TABCORP Holdings Limited (ASX: TAH)

ABCORP Holdings Limited (ASX: TAH) is one of the world’s largest publicly listed gambling companies. It is the leading player in the Australian market with a suite of customer brands that include TAB, Keno, Luxbet, TabcorpSky Racing and Sky Sports. We like this...

Market Wrap 11-08-2017

The last 12 months have produced solid gains in the stock market; overall the market is up 600 points or 11.7%. This is a good return in anyone’s books. The any negativity comes from the way this return has been achieved. Volatility is your friend in this market. Over...

Market Wrap 02-02-2017

Before Christmas the market was sitting on 5700, and I made the following predictions: 1. Retails sales would be slow over Christmas – they did, although not negative year on year growth was nothing to write home about....