Interest Rates

There is a lot of fuss around interest rates. Over the past six months all we have heard in the news is RBA, Inflation, Interest rates and Consumer Price Index (CPI).

For most Australians, we understand that the economy is not doing well. For those who have high levels of debt, you will already be feeling the effects of the interest rates increase. If you’re waiting for the interest rates to pull back. I would not hold your breath.

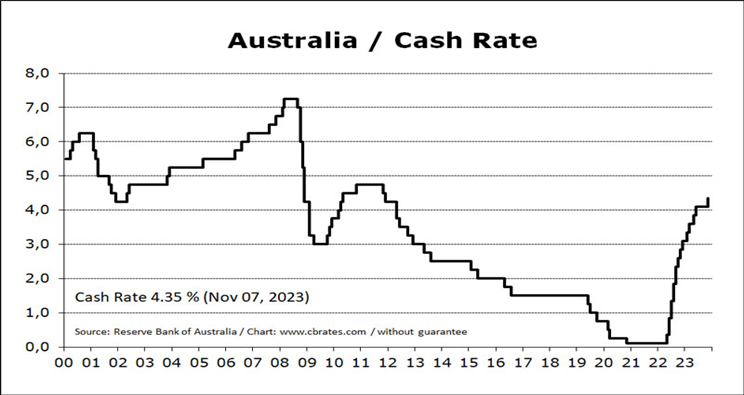

The above chart shows interest rates since 2000 to now. The highest interest rate in Australia was 17.50% in January 1990. At present inflation is still too high. To reduce inflation you need to increase interest rates, decreasing interest rates would increase inflation. The Government is in a dam if you do dam if you don’t situation.

This situation is due to COVID. The stimulus and lockdown created a unique situation. Between 2020 to 2022 debt in Australia went from 17 billion to 34 billion in Australia. At the same time interest rates jumped 4%. Add wages increases and government spending, the economy is in uncharted waters.

The government needs to increase interest rates to reduce inflation but doing that will cause debt stress in Australia like never before. The rapid rise of interest rates has pushed many Australians into mortgage stress already. Further increase would see families lose their homes.

What does this mean for the stock market. We can expect to see GDP reduce as households look to reduce expenditure. A recession is not out of the question, and I expect we will see a pullback.

For us investors, we need to review our investments and structure the portfolio for a slowdown in the economy.

Key changes to portfolios in our current market:

- Cash is king and interest rates are as high as we have seen in 10 years.

- Review debt levels of the investments you hold.

- Reduce exposure to those companies which rely on debt.

- Reduce exposure to retail sectors – we expect a slow down in retail.

- Hold large blue-chip companies with good cash flow and low levels of debt.

- Be cautious on property – commercial property is already slowing.

- Be careful holding illiquid investments.

- During these times look for opportunities to pick up assets trading below fair value.

However, there is also the trap of illiquid investments. Over the past couple of years there has been an increase in off-market investments. These investments generally have structured processes as to when you can access your money. These investments may restrict your ability to exit the investment if it is going bad.

As interest rates have not been changed yet, all we can do is watch and see what opportunities the market will provide.

If you have any questions, please contact our office.

AFSL 403509

51 Thuringowa Drive

Kirwan QLD 4817

Phone: (07) 4771 4577

Email: [email protected]

Jason Fittler: [email protected]

Jane Fittler: [email protected]