Over the long-term holding cash will have a negative effect on your investments. We all know and understand the effects inflation has on cash. However, there are times when being overweight cash makes sense. Over the past twelve months the ASX 200 has returned...

Newsletter

Control your investment

Back in 2022 a financial advice company Dixon Advisory collapsed. I expect most of our clients would have been unaware of the collapse. I raise the issue now as we are once going into a more volatile time in the market. I have below included an article in regards...

Market Update

Over the last 12 months the NASDAQ 100 is up 28%, the S&P 500 is up 23% compared to the ASX 200 up 8%. So why has the market not pulled back? The economy has three main pillars: the consumer, corporates, and the government. First, most consumers in the...

The pay later budget!

The 2024 budget when viewed over the coming 12 months period is a positive budget, however, longer term it is setting up the economy for tough times. My review of the budget is focused on the impact it may have on the economy over the longer term. Let review the...

Two buys and one speculative stock

But first a quick market update. The market has gained around 10% since the start of 2024. The market concerns have focused on inflation however, now inflation seem to be under control. Interest rates are expected to hold at the current rate with expectations of...

Market Update

Interest Rates There is a lot of fuss around interest rates. Over the past six months all we have heard in the news is RBA, Inflation, Interest rates and Consumer Price Index (CPI). For most Australians, we understand that the economy is not doing well. For those who...

Iron Ore – time to review material companies.

Demand for iron ore is stagnating. China represents 71% of the global seaborne iron ore market. China’s housing sector has slowed down and the economy showing clear signs of maturity and saturation. With the slow down on building property in China we expect that...

Investing in 2024.

Investors always look forward for opportunities and look back to learn the lessons the market provides each year. 2023 was a tough year with most of the gains coming in the last quarter. 2023 closed with a 7.8% gain.In 2024 the expectations are that Material and...

Before you start investing read this.

Investment Goals The goal of investing is to achieve passive income. Passive income is income which you do not need to work for. Before you start investing there are some basic concepts that you need to understand if not you will fail. Just reading this will put you...

Grow Your Wealth Market Update 11/01/2023

Reporting Season Positive – Future Headwinds

With the August reporting season, now closed overall the results were not as bad as expected. Most companies managed to cope with the rising cost and slow supply chains, with an underling demand for products and services, however, this maybe about to change. The...

Grow Your Wealth – Newsletter February 2020

February was a big month for the market. With pressure building as the market continued to climb, we were expecting a pull back in the market. With company valuations already fully stretched we had been recommending to clients for the past quarter to look at taking...

Newsletter December 2019 – Investing in 2020

Looking forward what do we expect for 2020.With 2019 being a good year on the markets should we expect more? The US has also performed well over the 2019 year but much like Australia we are starting to see signs of the economy slowing down. Given the large gains in...

Monthly Newsletter September 2019

Right now we have a number of issues which affect not just our market but World markets. At this point the market looks to be heading to all new highs but we need to put this in perspective. Our market topped in 2007 at 6850 points, in July 2019 the...

Grow Your Wealth – Monthly Update August 2019

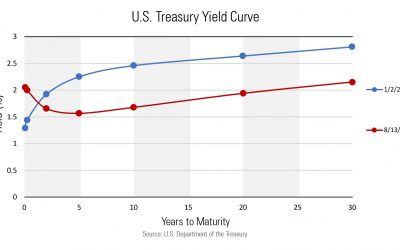

In a “normal” yield curve, long-term yields are higher than short-term yields. This makes sense because the longer someone borrows your money, the more you would expect them to pay you. A 5-year term deposit will pay a higher rate than a 6-month deposit because they...

Grow Your Wealth Newsletter – May 2019

With the surprise election result we have seen the market rally. We started May around 6360 points falling down to 6220 or 2.2% as we headed to the polls. With the LNP getting the win the market rallied back some 300 points or 4.8% over the following week, breaking...

Grow Your Wealth Monthly Newsletter April 2019

The Australian Market had a positive month in April, with a gain of 1.9%. Moving into May we are cautious due to the election and the uncertainty as to who will get in. Short term we expect that the market may pull back not just on the election but also as investors...

Monthly Newsletter March 2019

The Australian Market went nowhere in March 2019. We saw a pullback in the early stage of the month as investors took some profits on the back of a concern over interest rates. Australia has at present an inverted yield curve which means that long term rates are lower...

Monthly Newsletter February 2019

The Australian stock market had one of the strongest months on record with the ASX 200 producing a 4.9% gain for the month. Key highlight were companies reporting reduced profit growth which is indicating that we may start to see an economic slowdown. Banks stocks...