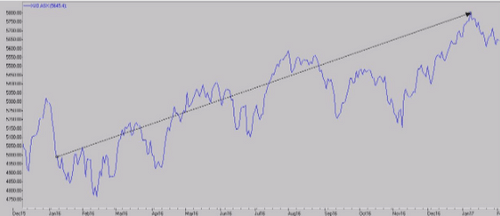

Before Christmas the market was sitting on 5700, and I made the following predictions:

1. Retails sales would be slow over Christmas – they did, although not negative year on year growth was nothing to write home about.

2. Interests rates would move up in 2017 – no move yet but all of the talk is pointing up. Bond rates have already moved up almost 1% in the United States.

3. Governments would announce infrastructure spends – this has not happened yet but I am still confident that it will. Jobs are the key to economic recovery.

The ASX 200 rose to 5800 before pulling back to the current level of 5600, I still expect to see it above 6000 point this year.

The Trump affect (putting politics all aside) has seen a renewed focus from our leaders to focus on issues such as job creation. Infrastructure is the key to creating jobs and rebuilding the economy.

Add to this the recovery in the material sector over the past 6 weeks (8% gains) and a 15% return for the ASX 200 for the past 12 months, the recovery underway. This s provides opportunities for investors with many quality companies paying dividends over 5% and trading below fair value.

Keep in mind that Value Investors looks to buy when companies are oversold and cheap; there are some good opportunities at present, as long as you are prepared to wait.