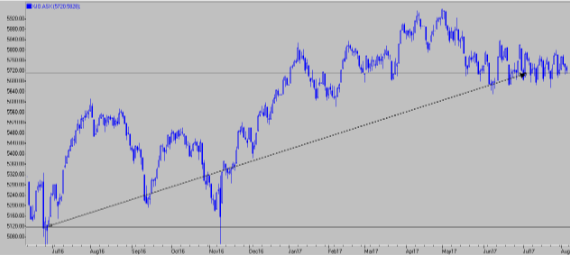

The last 12 months have produced solid gains in the stock market; overall the market is up 600 points or 11.7%. This is a good return in anyone’s books. The any negativity comes from the way this return has been achieved.

Volatility is your friend in this market. Over the past 12 months the market has twice fallen below 5000 points and twice been above 5900 points, this is a difference of 18%. All of this volatility has left the general public with the impression that our stock market is struggling. It is quite the opposite.

The drops have provided plenty of opportunity to grab some bargains and the highs have allowed for some profit taking. However, investing is all about looking to the future, so what can we expect over the next 12 months.

More volatility, the world markets have not settled, Australia economy is still in uncertain times. Our government continues to struggle to prove any clear direction. Elections are pending both state and Federal and both will have an effect on investors and in turn the market.

The May 2017 budget with its promises of Infrastructure spending gave the market a kick along in. The spending announced will not only get our economy moving but provide the sort of infrastructure which will also allow efficiency dividends to businesses of the future. We are waiting now for delivery of the budget promises.

The market has been in a sideways holding pattern since May, I expect this to continue through the reporting season, which we are currently in. Any companies who under perform will be sold down by investors, which indicate to me that investors are still nervous. I expect the market to continue to be volatile for the coming months, this will provide opportunity to take profits and buy under valued companies.

Our Grow Your Wealth SMA has continued to outperform the benchmark, as detailed below, with the Assertive index fund producing a return of 10.23% against the benchmark of 8.36%.