The stock market is all about looking forward and knowing the past so you can be ahead of the curve. Bank Failures Two banks in America failed last week and there are expectations that other banks are also close. How does this happen? A simple explanation of how banks...

Market Wrap

Grow Your Wealth – Market Wrap February 2021

The evidence is that valuation inthe US are stretched especially in the tech sector, there is a flood of IPOwith strong support and high valuations. At present the market is geared to 43%and bond rates are all time lows forcing fixed interest investors into riskier...

Grow Your Wealth – Market Wrap 18/09/2020

It has been a couple of months since our last Market Update, during that time nothing really changed. Our market continues and is still trading in arange between 6200 and 5800. Reporting season is over with results being slightly better than expectations and...

Grow Your Wealth – Market Wrap 17/07/2020

The big issue will be unemployment currently quoted at 7.5%. Job Keeper and Job Seeker are keeping the unemployment figures under control at present. However,these programs are to be wound back at end of September, the government is looking to provide a revise...

Grow Your Wealth – Market Wrap 03/07/2020

Our market has recovered 30% since the initial shock in March. But we are not alone, the US is leading the way and is currently now only down 7% from the pre COVID 19 levels. The ASX 200 is trading around 6000 points down around 17% from the pre COVID 19 highs. Click...

Grow Your Wealth – Market Wrap 19/06/2020

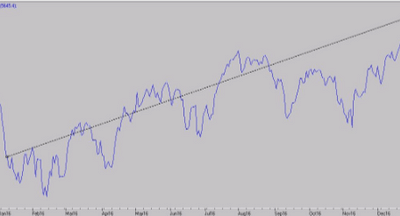

Back in Australia our recovery was 40% at its peak, but is now retracing back into a trading range. As shown in the below chart our market seem to be trading in a channel between 5750 and 6200. Volatility has is sitting around 24 which is still high but the trend is...

Grow Your Wealth – Market Wrap 05/06/2020

We could see our market move up another 5%, however we are still cautious on which companies we buy given that the bond market does not seem to be supporting the market at present. This could indicate a possible retest of the recent lows. Click for full article

Grow Your Wealth – Market Wrap – 22/05/2020

We do not recommend to heavily invest at these levels, now is the time to top up some holdings and to start building positions in new companies. It is also a good time to think about selling out those companies with a low chance of recovery. Click for full article

GROW YOUR WEALTH – MARKET WRAP 15/05/2020

Do not be fooled in to thinking, that everything is now OK, far from it. What we are seeing is the market hedging their bets on the recovery as restrictions are lifted. It will all be about the economic data over the coming months. This will be a slow long recovery,...

Grow Your Wealth Market Warp – 01/05/2020

For all of us dividend loving investors do not worry too much, it is more of a precaution which all of the banks will follow, Westpac has hinted that there will be no dividend this half. Bank stocks dropped over 5% on Friday on back of expectation all banks will...

Grow Your Wealth – Market Wrap 24/04/2020

The market this week found support around 5200 after falling at the start of the week. We are looking beyond COVID 19 and focusing on the economy and how the government will fund the stimulus package. What is clear is that interest rate will stay low for years while...

Grow Your Wealth – Market Wrap 17/04/2020

Another mixed week with the market closing up slightly. Most of the gains were made on Friday, given that the futures were barely positive as the start of the day I would contribute these gains to the news that we could see restrictions from COVID 19, start to be...

Market Wrap 09/04/2020

Going into the Easter break we expected that the market to close down as investor sit on the sideline over the Easter break.Instead it continued to hold around current levels. The banks came under fire as New Zealand put in place measure to ensure better liquidity in...

Market Wrap 02/04/2020

Last week the market closed at 4842, this week we closed up 225 points at 5067. There was more support for the market this week as it moved to it high in the middle of the week before pulling back on Friday. There is plenty of opportunity in the market to buy...

Market Update – 27/03/2020

The ASX 200 held its ground this week. In a falling market it provided some sweet relief, however, it did sell off in the last trading hours to end down 5.3% for the day leaving the market flat for the week. By no means do I expect that this is a bottom but it may...

Market Update – 20/03/2020

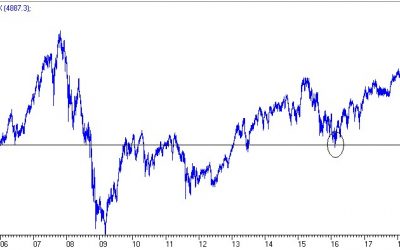

The ASX 200 continued its downward move this week closing at 4900 points with the market down 28% from the highs of only a month ago. The market has traced back to the lows of 2016 which is considered a resistance point. If the market bottoms around this level, we...

COVID 19 – Grow Your Wealth Market Update

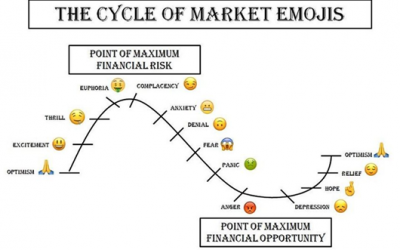

With the market recording some of the biggest drops in history what should you do as an investor. First, DO NOT PANIC, the time to panic has passed. What is the core reason for your investments? 1. Provide for living expenses. Make...

Market Wrap 06-03-2018

In 2013 the Australian market started the recovery out of the GFC. At this point volatility was still high it took two years before it broke through the 6000 points for the ASX 200 in February 2015. This was a mile stone as 6000 points was a resistance level. Over the...

End of Year Market Wrap 2017

Just over 12 months ago all we heard in the Media was Donald Trump, 12 months on not we are still hearing about Donald Trump but the wealth of the USA has increased. In fact the overseas has outperformed with Hong Kong up 29%, United States of America – NASDAQ up 29%,...

Market Wrap 11-08-2017

The last 12 months have produced solid gains in the stock market; overall the market is up 600 points or 11.7%. This is a good return in anyone’s books. The any negativity comes from the way this return has been achieved. Volatility is your friend in this market. Over...

Market Wrap 02-02-2017

Before Christmas the market was sitting on 5700, and I made the following predictions: 1. Retails sales would be slow over Christmas – they did, although not negative year on year growth was nothing to write home about....