Process and Philosophy

At Grow Your Wealth, we don’t speculate with client’s money. We focus on finding undervalued investments providing high levels of income. We build portfolios which focus on providing the income our clients need to achieve financial freedom in all types of markets. For us to move away from this approach would introduce risk levels such that our clients would not be adequately compensated.

Asset Allocation is the Primary Portfolio Decision

The most important decision for your investment portfolio is your recommended asset allocation. This is because studies have shown that your chosen asset allocation is responsible for more than 90% in the variability of returns between portfolios.

Your Lifestyle Goals and Time-Frame

The investment time frame you have for you to achieve your lifestyle goals and objective is one of the main determinants in your asset allocation, and primarily the allocation between the main classification of different types of assets (i.e. defensive and growth assets). The shorter your time frame, the more your portfolio should be exposed to defensive assets to reduce volatility; and similarly the longer your time frame, the more your portfolio can recover from volatility and therefore can be more exposed to growth assets.

Rate of Return Required

In order to achieve their investment and lifestyle goals, some clients are likely to need to achieve a return greater than inflation. Inflation reduces the spending power of your money and not generating a return above inflation may result in you not being able to afford your desired lifestyle.

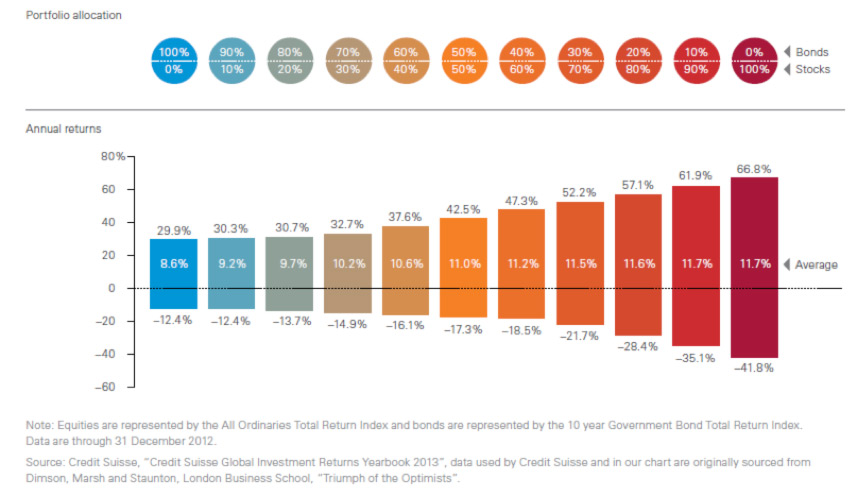

The chart above shows the range of returns historically generated by various asset allocations. Typically, the higher the rate of return required, the higher the risk you need to be willing to take to achieve your lifestyle goals and objectives.

There will be some years where the actual return will be lower, even negative, and some years higher. Uncertainty in future investment returns means that the actual performance of your portfolio may differ from our straight line financial modelling that will be outlined in your Statement of Advice, and can therefore impact on your financial outcome.

Potential Asset Allocations

Once we have identified your investment time-frame and your required rate of return, we can determine which potential risk profile or asset allocation may be appropriate to achieve your lifestyle goals and objectives.

Constantly Picking Winners is Difficult

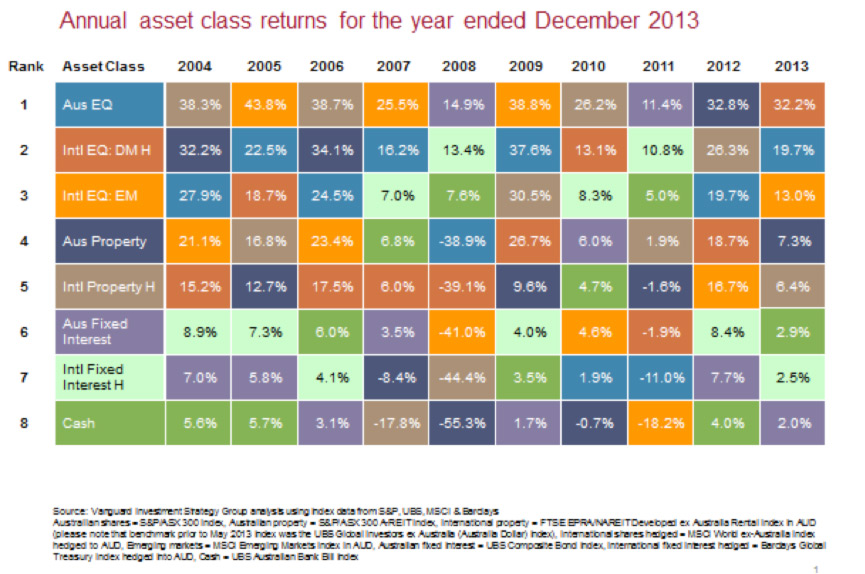

Australian Equities (in Blue) demonstrates the movement from almost bottom to top and back again. If we changed this table to financial years we would get a different set of numbers and colours. Dynamic asset allocation or market timing across asset classes is absolutely fraught with danger. You may well get it right once, twice if you’re lucky and blow it on the third attempt. Investing without diversifying is like going outside without an umbrella. If you are prepared only for sunny days, you expose yourself to unnecessary risk. In the world of investment, avoidable risks include holding too few securities, betting on specific countries or industries, following market predictions and speculating.

By spreading your investments across different types of asset classes, you can create a portfolio built for all climates. This is because as one asset class is performing poorly, another may be doing well. This is not to say you won’t see a little rain from time to time, but diversification lessens your chances of getting drenched.

The key is to focus on things you can control, take only risks where there is an expected return, understand what you are investing in and choose an asset allocation that’s right for your own goals and risk appetite. Diversify your investments as broadly as possible, pay attention to costs and taxes which make a big difference and stay disciplined – only change your investment strategy when your needs or circumstances change, not when the market does.

However tempting it is to invest in the previous years’ best performing fund. Investors have earned significantly less than the funds themselves—in part because many invest only after a fund starts looking “hot,” and thus never see the gains that got it that reputation. The data suggest that, on average, market-timing is hazardous to long-term investing success.