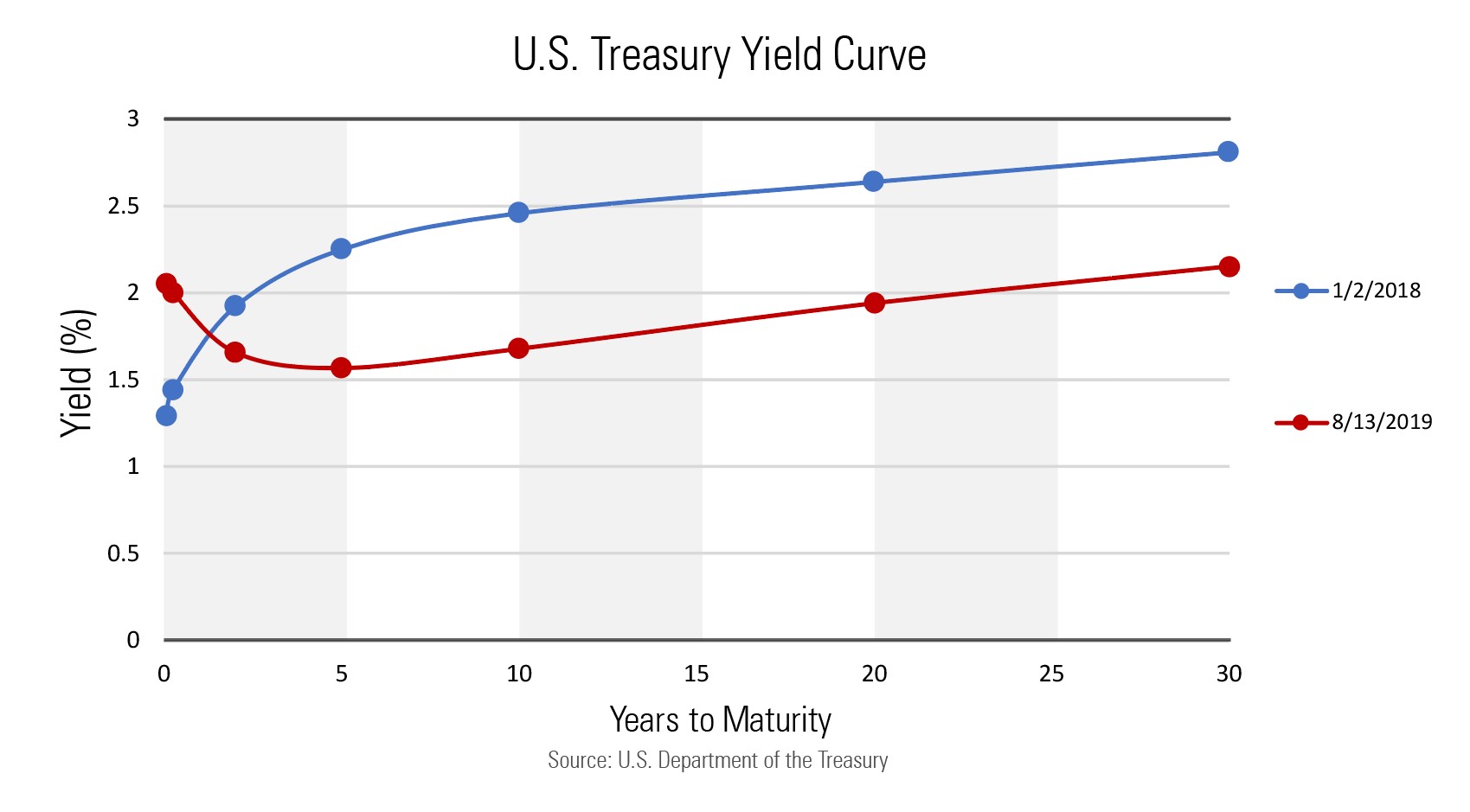

In a “normal” yield curve, long-term yields are higher than short-term yields. This makes sense because the longer someone borrows your money, the more you would expect them to pay you.

A 5-year term deposit will pay a higher rate than a 6-month deposit because they have your money longer and there is more risk associated with a longer investment.The inverted yield is when investors require higher rates of interest in the short term than they do for long term deposits.